The year FinTech Platforms Stop Reacting and Start Deciding

Executive Synopsis

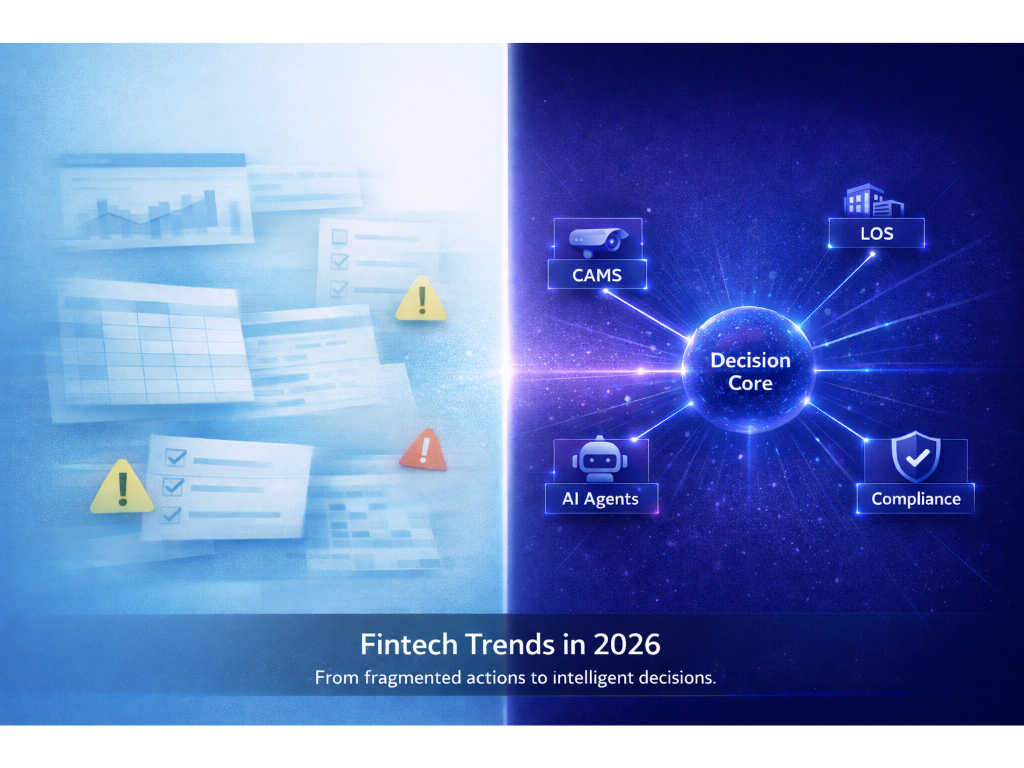

Over the last decade, FinTech platforms have become faster, more digital, and more connected—but not necessarily more decisive. In 2026, that changes. Loan Origination Systems (LOS) and Credit Assessment Memo System (CAMS) will evolve into the operating backbone of lenders, powered by platform thinking, agentic AI, policy-as-code, and compounding intelligence. The winners will not be those with better dashboards, but those that build decision-grade operating architectures.

Reality Check: Why Business as Usual Is No Longer Viable

In my experience working across financial services and digital infrastructure, I’ve seen multiple technology cycles promise transformation. Core banking rewrites. Data lakes. AI pilots. Dashboard revolutions.

What makes 2026 different is not innovation.

It’s pressure.

Pressure that is structural, sustained, and unforgiving:

- Pressure from regulators demanding explainability, traceability, and continuous audit readiness

- Pressure from technology sprawl and brittle integrations

- Pressure from macroeconomic and geopolitical volatility

- Pressure from customer expectations shaped by instant digital experiences

- Pressure from margins that no longer tolerate inefficiency

Across India’s lending ecosystem, these pressures have exposed systemic failures.

Loan processing speed is no longer a hygiene factor—it is existential.

Borrowers—individuals and businesses alike—need capital when opportunity arises. A delayed decision is often a lost one. And yet, despite years of digitisation, many NBFCs still take 3–7 days to process loans. New-age fintech lenders do it in minutes. Time-to-decision is no longer an operational metric. It is a survival metric.

Traditional credit scoring continues to leave material blind spots.

Static financials and bureau scores struggle to capture cashflow volatility, informal income, thin files, and behavioural risk. Low financial literacy, inconsistent data quality, and limited financial inclusion widen these gaps further. In a dynamic economy, this results in systematically mispriced risk.

Dashboards have increased visibility—but not velocity.

Leadership teams now have more reports than ever. Yet decisions still bottleneck around manual reviews, exception handling, and fragmented systems. Seeing the problem faster does not solve it if execution still depends on humans stitching workflows together.

Compliance has quietly become an operational tax.

Regulators now expect real-time explainability, immutable audit trails, and continuous compliance. Manual controls and post-facto reporting cannot scale with volume or complexity.

The conclusion I’ve arrived at after watching this play out repeatedly is unavoidable:

Systems designed to record activity cannot run modern lenders.

The New Paradigm: From Applications to Operating Systems

2026 will be governed by a single, non-negotiable shift:

From IT services, dashboards, and point tools to → LOS & CAMS-led operating systems, agentic decision execution, and AI-native platforms with memory.

| The last decade was about: | The next decade will be about: |

| Digitisation | Autonomous decision execution |

| SaaS adoption | Policy-driven intelligence |

| Visibility and reporting | Compounding institutional learning |

This is not an upgrade cycle.

It is a transformation in the operating logic itself.

Trend 1: SaaS Gives Way to Composable FinTech Frameworks

Mechanism of Action

I am seeing Banks and NBFCs actively replacing monolithic systems with modular, composable capability frameworks—identity, credit, risk, payments, compliance— assembled as plug-and-play building blocks. Regulation changes or new products no longer require full re-architecture.

Resulting ROI

- Faster product launches and scalability

- Lower cost of regulatory change

- Greater system resilience

Truth:

FinTech

Winners won’t sell software—they’ll sell building blocks.

Trend 2: LOS to Become the Decision Backbone

Loan Origination Systems are no longer workflow engines. In 2026, LOS will evolve into the core operating system of lenders, combining:

- Underwriting Brain – intelligent decision-making by evaluating complex credit scenarios

- Policy Enforcement Layer – real-time compliance and risk management

- Portfolio Memory – historical intelligence that learns & improves across cycles and products

Mechanism of Action

LOS orchestrates CAMS intelligence, data ingestion, policy logic, and execution. It becomes the system where decisions are made, not mere engines of transactional processing. In effect, LOS emerges as the central nervous system of the lender coordinating underwriting intelligence, enforcing lending policies, and maintaining institutional memory across the entire portfolio.

Resulting ROI

- 40–60% reduction in underwriting effort

- Faster approval cycles without risk dilution

- Consistent decisions across channels

Reality:

LOS is not a system anymore. It’s the lender’s operating system.

Trend 3: From Copilots to Agentic Decision Systems

Dashboards and copilots assist humans. Agentic systems execute decisions.

Mechanism of Action

Supervised AI agents will autonomously:

- Run underwriting checks

- Enforce policy rules

- Handle exceptions

- Escalate edge cases

All actions are logged, explainable, and auditable by design.

Resulting ROI

- Lower operational load

- Faster decision cycles

- Reduced human error

Bottom line:

AI won’t assist decisions in fintech. It will safely execute them within defined guardrails.

Trend 4: AI-Native Engineering Replaces IT Services

The traditional IT services model based on staff augmentation, project delivery and hour-based billing, does not compound value.

Mechanism of Action

AI-native engineering focuses on:

- IP-led platforms

- Accelerator driven development

- Outcome-focused delivery

- Systems that learn with every deployment

Each implementation builds reusable accelerators and deliver measurable outcomes strengthening the core platform. AI-native engineering is a fundamental change in how fintech solutions are built and delivered.

Resulting ROI

- Faster time-to-value

- Lower total cost of ownership

- Compounding intelligence across clients

Hard truth:

If your fintech services don’t compound IP, you’re already obsolete.

Trend 5: Compliance will Become a Product Architecture

Compliance is no longer downstream.

Mechanism of Action

- Policy-as-Code embedded directly into system logic and workflows

- Consent orchestration with governed hierarchical data access

- Real-time audit trails will emerge as single-source-of-truth

Resulting ROI

- Reduced compliance overhead

- Faster regulatory approvals

- Zero audit panic

New reality:

In fintech, compliance is no longer a cost—it’s a product feature.

Trend 6: Vertical AI Replaces Horizontal GenAI

Generic GenAI lacks domain depth and regulatory explainability.

Mechanism of Action

Deep-trained, contextual AI understands:

- Credit logic

- CAMS workflows

- Regulatory expectations

Decisions are explainable by design.

Resulting ROI

- Improved understanding of lending logic

- Better risk outcomes

- Regulatory confidence

- Defensible intelligence

Bottom line:

Fintech doesn’t need smarter chatbots—it needs defensible intelligence.

Trend 7: Platforms With Memory Become the Moat

The most durable advantage in fintech is not features—it’s continuous learning.

Mechanism of Action

Platforms collate and store data, learn from it, and will reuse intelligence from every data-driven decision across products and portfolios.

Resulting ROI

- Continuous improvement

- Sustainable risk reduction

- Institutional intelligence at scale, compounding values

Reality:

In fintech, memory—not features—is the real moat.

The New FinTech Operating Stack: 2026 Blueprint

The modern lending platform integrates:

- Intelligence – Contextual AI & CAMS

- Processing – LOS as the execution backbone

- Execution – Agentic decision systems

- Compliance – Policy-as-code, audit-ready by design

Together, they create a Decision-Grade Operating Environment.

The New Era of Certainty

In conclusion, 2026 is not about experimentation. It is about mandates.

Lenders that continue optimising legacy systems will fall behind those that redesign how decisions are made, executed, and governed.

The future belongs to platforms that decide autonomously, learn continuously, and comply inherently.

That is the new era of certainty—and there will be no shortcuts.

Ramanan Ramakrishnan is the CEO of Obidos Labs and Innoventes, with over 25 years of experience building and scaling hyper-scale software platforms and AI-driven products. Since founding Innoventes in 2015, he has led innovation across fintech, healthcare, retail, and supply chain technology, helping enterprises modernize their digital and operational cores. He has held senior leadership roles at Oracle, Pegasus, and Dun & Bradstreet, where he built enterprise platforms spanning SCM, collaboration, hospitality, and data-led decision systems. With deep expertise in cloud-native architectures and large-scale data platforms, Ramanan focuses on creating decision-grade systems where intelligence compounds, compliance is embedded by design, and platforms continuously learn.